The Indian equity markets, consisting of the National Stock Exchange and the Bombay Stock Exchange, act as an economic indicator conveying the monetary soundness of diverse industries. The companies listed on the NSE and BSE market capitalisation is $5.41 trillion (July 2024). As of late August 2024, the markets have displayed noteworthy vitality, with select divisions achieving outstanding growth.

This article delves into a sector-by-sector breakdown of the top gainers noted on the NSE and BSE exchanges, investigating where financial specialists are steering capital and what this could signify for potential opportunities.

So, let’s begin without further ado.

Effect of Macroeconomic Variables

Evolving macroeconomic conditions have produced fluctuations in performance across multiple domains. Whereas certain areas have benefited from significant upside, others have witnessed retrenchment. A deeper review of the prevailing trends offers insight into the underlying drivers shaping current movements and the sustainability of recent changes in relative valuations between alternative segments. The commodity market has experienced volatility due to shifts in global supply and demand dynamics, which have, in turn, influenced the performance of related sectors, including metals and mining.

Understanding Market Dynamics

Before diving deeply into specific sector analyses, it’s crucial to grasp the overarching marketplace dynamics influencing share performance.

Global Economic Conditions

Varied variables, including global economic circumstances, impact the Indian securities market. Economic indicators from pivotal economies like the United States and China noticeably sway investor emotions in India. Worldwide inflation rates, interest levels, and geopolitical tensions can potentially result in fluctuations in stock prices.

Domestic Economic Factors

The health of the domestic economy, characterised surprisingly by GDP growth, inflation rates, and work statistics, plays a pivotal role in shaping market trends. Governmental policies, like fiscal measures and regulatory alterations, also sway the position of BSE and NSE top gainers.

Sector-Specific Trends

Each sector has special qualities and drivers. Technological advancements can surprisingly propel the IT sector, whereas regulatory changes might impact the banking sector otherwise.

Foreign Institutional Investment

FIIs are significant players in the Indian securities market, and their investment patterns can lead to substantial cost movements. Increased FII inflows often indicate confidence in the Indian economy and determine which will be the top gainer’s stocks.

Market Sentiment

Investor emotions, swayed by news, happenings, and market trends, can lead to unpredictability. Bullish emotions can drive prices up, while bearish emotions can lead to sell-offs.

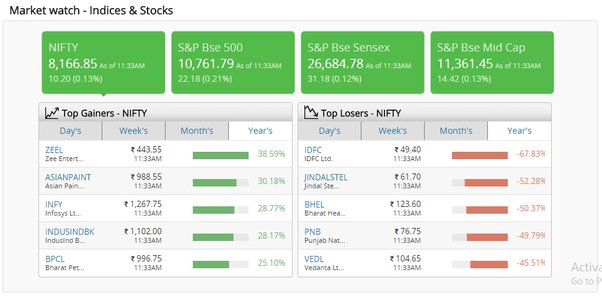

Top Gainers of 2024

As of mid-August 2024, several Indian stocks have emerged as notable outperformers on the nation’s two largest exchanges. Among those seeing rapid share price growth include:

- SBILIFE is driven by robust quarterly financials and escalating demand for risk coverage plans amid ongoing economic uncertainty.

- Also surging has been automobile giant MARUTI, reaping the rewards from reinvigorated consumer spending on vehicles and strategic investments in electric drivetrains to proactively comply with impending emissions regulations.

- HDFCBANK, one of the dominant names in the domestic banking universe, continues to demonstrate resilience through steady loan expansion and a sound asset quality position.

- Meanwhile, metal manufacturer HINDALCO has been lifted by appreciating aluminium and copper prices against a backdrop of rebounding construction activity and automotive output volumes.

Sector Performance Analysis

To identify where the money is flowing, we need to analyse the performance of key sectors represented by these top gainers.

1. Financial Services Sector

The financial services industry has become significant in the Indian equity market. Particularly, banking institutions and insurance firms have leveraged economic restoration following the pandemic, experiencing expanding credit demand and improving asset quality. Meanwhile, the administration’s emphasis on financial incorporation and digital lending has additionally propelled advancement.

Top Performers

HDFC Bank and SBILIFE have stood out as stellar performers, reflecting robust fundamentals and shareholder belief. HDFC Bank’s powerful loan development and SBILIFE’s widening customer base have contributed to their stock price appreciation. Going forward, the financial services sector is anticipated to continue its positive trajectory, driven by digital transformation, swelling personal earnings, and a growing middle class.

Moreover, some analysts argue that the sector is well-positioned to capitalise on finance modernisation initiatives and grow its customer base among newly included populations. Whether this bullish outlook proves accurate remains to be seen, but the underlying drivers of financial inclusion and deepening internet penetration look good for ongoing progress.

2. Information Technology (IT) Sector

The Indian IT sector has proven to be remarkably resilient, bouncing back from setbacks by evolving swiftly. As digitalisation spreads through every industry, the demand for technological know-how in programming, networking, and security surges. Corporations invest heavily in cloud infrastructure, machine learning, and cyber protections to future-proof operations.

Top Performers

This drives significant growth for leading service providers such as Tata Consultancy Services and Infosys, catering to international clients’ hunger for high-tech support around the clock. These giants have strengthened their industry footholds by relentlessly innovating solutions tailored to changing market conditions.

Overall, India’s prominence as a global hub for IT expertise appears poised to endure, fueled by digitisation’s growing infiltration of sectors from agriculture to healthcare. Nevertheless, recruiting and retaining top tech talent remains vital as skill competition intensifies worldwide.

3. Pharmaceutical Sector

The pharmaceutical industry has emerged, especially amidst the COVID-19 pandemic. Demand for medical products, inoculations, and remedies drives the sector’s expansion. Also fueling growth is an ageing populace and swelling healthcare costs.

Top Performers

Giants, such as Sun Pharmaceutical and Dr. Reddy’s Lab have experienced good growth and are propelled by robust pipelines and worldwide reach. However, smaller players may find opportunities in niche or speciality areas poorly served by larger competitors, leveraging innovative business models or alliances to overcome resource constraints and bring much-needed treatments to market.

4. Metals and Mining Sector

The metals and mining industry has seen a revival fueled by escalating global commodity prices. Higher needs for metals in construction, automotive manufacturing, and infrastructure projects have given a lift to this sector. The global economic turnaround has also played a role in pushing metal prices higher.

Top Performers

Hindalco has become a pivotal participant, profiting from its varied product lineup and solid marketplace position. While the metals and mining sector is projected to stay robust, powered by infrastructure and industrial expansion outlays, unpredictability in commodity pricing and environmental rules may influence the NSE and BSE top gainers.

Investment Strategies

Investors seeking to maximise returns amid current fluctuations would benefit from implementing diverse tactics. Not only is it necessary to spread funds across industries, but meticulously analysing fundamentals, revenue increases, profit margins, and liabilities is also needed.

Closely monitoring shifting trends, indicators, and events worldwide provides perspective on potential opportunities, while shortsightedness risks volatility. A long-term vision recognises that though periods of instability are inevitable, companies demonstrating enduring growth will be rewarded handsomely.

Conclusion

Analysing the largest gainers on the National Stock Exchange and Bombay Stock Exchange reveals meaningful insights into where capital is circulating within the Indian equity market. The financial, information technology, pharmaceutical, and metals industries have experienced robust growths, propelled by diverse economic and market dynamics. Investors would be wise to remain vigilant using a tool like the Research 360 app from Motilal Oswal to leverage sector performance insights and make informed judgments.